Why IT Makes Sense to Stay Out of This Bubble in Indian Markets

While it is indeed hard to stay out of bubbles and remain patient, it sure pays off in the longer run. The most important benefit is that, it preserves your rationale. The market sucks in everyone in its euphoria. People tend to make a lot of money in manias, but it’s very hard to retain them. But of more importance is the mental state that gets pulled far away from the rational perspective. We tend to get surprised by any event that’s outside the norm simply because our focus revolves entirely around the normal expectations.

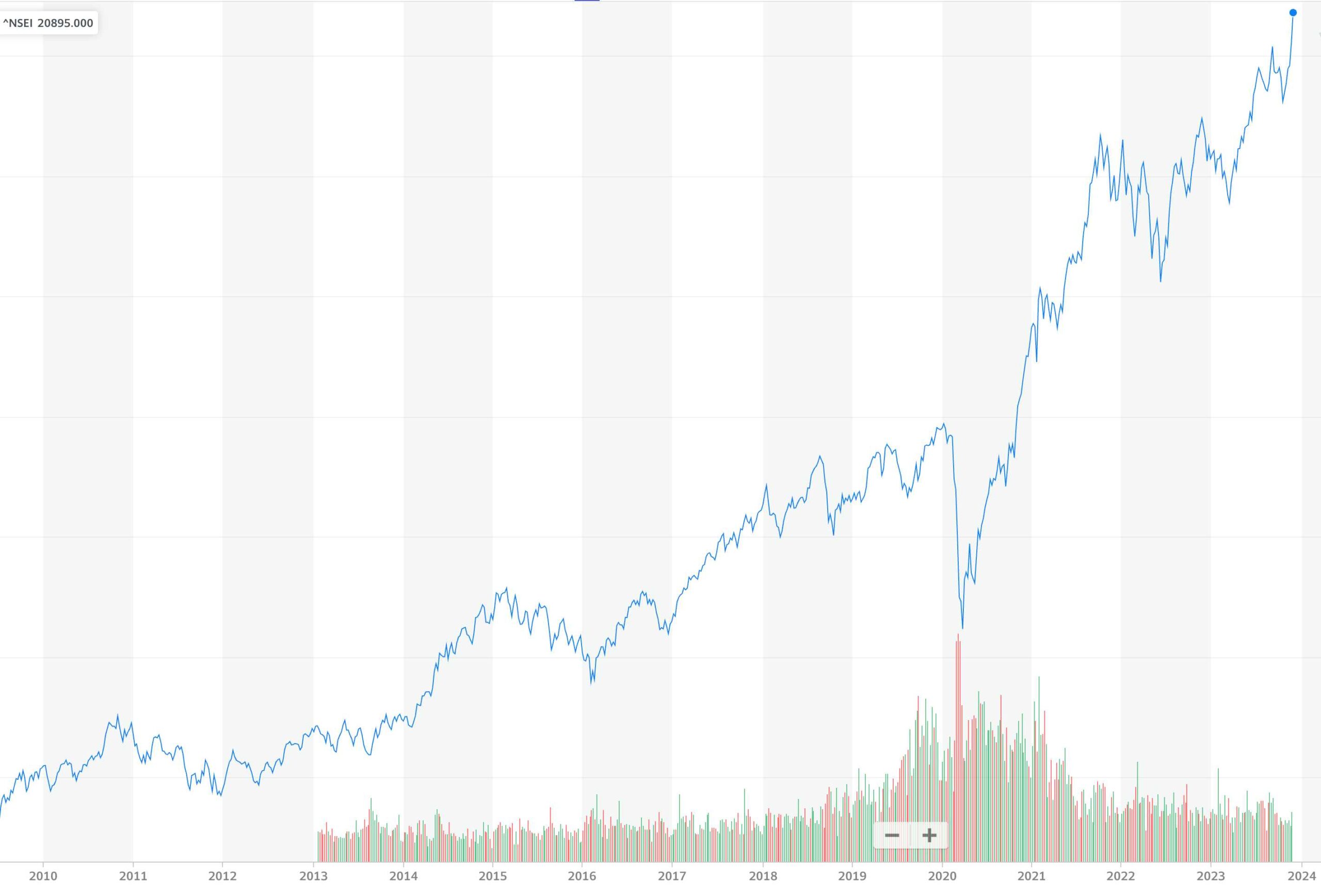

The Indian market seems to be the only market that is more over valued than the US market. And somehow, most people in India are hesitant to call it for what it is. It is even safe to say that, this bubble may be the biggest India has seen so far, since we have emerged as a major economy only this time around. Back in 1991, 2000 or 2008, the size of the economy and markets were far small.

Some key points that are to be kept in mind about Bubbles –

1. Bubbles are formed out of leverage. The Risk is hidden in the system.

2. A new generation has jumped into the markets.

3. Extreme short term trading behavior

4. New modes of communication are typically used.

5. New Business models and Technological innovation are present.

6. Bubbles bursting have led to the worst economic conditions

7. Crazy Investor Behavior

8. Higher the optimism, bigger the bubble, worser the side effects afterwards.

An Intelligent Investor is one who has the mental ability to stay out, till the mana ends. And when it ends, there is blood on the street, to the point that the people swear to never go near Derivatives, New age Tech, loss making companies. Such is how speculative peaks have ended in 1929 and 2000.

What makes this bubble even more dangerous, would be three phenomena underway –

* The Consumer culture built on debt with EMI’s and Buy now pay later. The NBFCs have played a

huge role in this.

* The Buy at any price phenomenon (BAAP) – is similar to the 1929 ‘Companion theory’ for blue chips

that no price was too high for them.

* 0DTE – Derivative trading phenomenon.

Its very hard to foresee things going wrong, when we are in the Bubble, as they are built on a strong foundation with rosy economics and fundamentals. Hence these signs along with the crazy investor behaviour are the warnings that are to be paid attention to. Of course, the crazy valuations stand out. But the long Bull market tends to pull the minds away from the basics of valuation. Seeing the 100 times earnings, 40 times earnings seem reasonable.

The key point to bear in mind is that, just as the markets swing wildly on one side, it will also swing wildly on the other side. Higher the valuation, higher the risk. When stock valuations are relatively cheap, an investor might consider the macroeconomic picture as irrelevant. However, when valuations reach extremes, it would be imprudent to ignore the macroeconomic landscape. Lost decades tend to occur from these points, underscoring the importance of considering broader economic factors during periods of extreme valuation.

– Dr. Siddarth.K.J

Fund Manager