Even as valuations have risen rapidly, investors remain optimistic about the current situation. However, overvaluation and bubbles are attributed to extensive credit and leverage, feeding on each other in a vicious cycle. Unlike in the United States, where the...

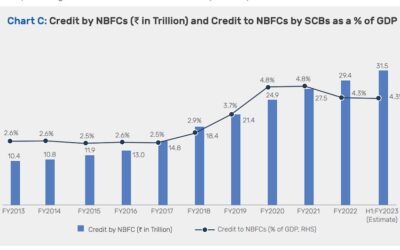

Closer Look at The Financial Sector Risks in India

A few years of positive GDP growth and an increase in earnings, along with sustained elevated overvaluation, seem to be a perfect mix to lure investors into forgetting the fundamentals and rational thought processes. While optimism is essential, as a prudent investor,...

Why IT Makes Sense to Stay Out of This Bubble in Indian Markets

While it is indeed hard to stay out of bubbles and remain patient, it sure pays off in the longer run. The most important benefit is that, it preserves your rationale. The market sucks in everyone in its euphoria. People tend to make a lot of money in manias, but it’s...

THE CASE FOR A PROLONGED RECESSION

We tend to get surprised by any event that's outside the norm simply because our focus revolves entirely around the normal expectations. Hence, we are caught off guard when a pandemic occurs, or a pandemic-related sell-off transpiresor any supposedly rare event...

NEARING THE CRISIS

As a fund manager, I perceive my role as that of the Chief Risk Officer. In investing, differentiating skill from luck in the short term is challenging. Even a monkey randomly selecting stocks with darts can make money in the short and medium term, possibly...

PLAYING WITH FIRE

THE FIRST LETTER - It's intriguing how life often weaves connections in unexpected ways. My own journey into the world of finance began during my college years, guided by my father's warnings about overvalued markets. Little did I know that this introduction would...