Closer Look at The Financial Sector Risks in India

A few years of positive GDP growth and an increase in earnings, along with sustained elevated overvaluation, seem to be a perfect mix to lure investors into forgetting the fundamentals and rational thought processes. While optimism is essential, as a prudent investor, one must remain aware of all risks, including the possibility of extreme events. During times of exuberance, being vigilant for tail risks is essential. The advantage of this awareness is that one can stay prepared and prevent panic.

Overvalued markets often result from leverage. The deleveraging process, an inherent part of the cycle, is always painful. However, investors are often caught off guard as they focus excessively on the current situation, which is brightest at the top. Hence, they walk right into financial tipping points. On the other hand, a risk-aware investor can stay calm and rational during turbulent times, creating opportunities out of difficult periods. As always, opportunity comes to the prepared mind, with good times following bad times and vice versa.

Before we proceed, it’s essential to note that the Indian banking system is well-regulated. Reforms, particularly those implemented during Raghuram Rajan’s tenure, have provided a strong foundation. However, history makes it clear that, regardless of how well-regulated the system is, booms and busts are part of the cycle. In this article, we will explain how they tend to pan out repeatedly and discuss the current situation.

While it is nearly impossible to predict when extreme events like a financial crisis will occur, there are several signs that a prudent investor can use to form a judgment:

• Overvalued Financial Assets

• High Growth Rate of Debt

• Lower Provisioning by Banks and Financial Entities

• Lax Lending Standards

• Over-Optimism About the Future

• Loose Monetary Policy

• Innovative Financial Products

• Money Flow to Non-productive Parts of the Economy

• The Risks are Completely Ignored/Hidden in the System.

Some major risks loom over us:

1. Global tightening cycle with Quantitative Tightening (QT).

2. Foreign outflow of capital due to currency depreciation.

3. High debt growth – particularly consumer loans by Non-Banking Financial Companies (NBFCs).

4. The abnormally low provisioning of the Public Sector Undertaking (PSU) Banks.

While any of these factors can play a major role, it’s important to bear in mind that the debt cycle plays out with both an upcycle and a downcycle as a normal part of the process. The mentioned factors tend to exaggerate the downcycle due to the excesses. Unlike in developed economies, where conclusions can be drawn from data like unemployment and bankruptcies, in India, it becomes even more important to have a higher margin of safety in forming judgments.

The Indian financial markets have performed exceptionally well in the recent past, but there appear to be underlying issues. Some notable concerns include consistently high fiscal deficits (more than 6% for the last 3 years), inflation levels consistently above the upper band of tolerable levels (though they have come down this quarter, the high base effects must be considered), very loose financial conditions, and low yield differentials with US yields (leading to weakening of the currency and currency defense). All of these factors have second-order effects, which will be discussed. Importantly, consumer debt levels have risen significantly compared to income levels, and job creation, especially in the IT sector, has stalled. This sector has been a leading force for Indian consumption, and significant ramifications may be expected. For the first time in the last twenty years, there’s a noticeable slowdown, and while some attention was paid to this in 2022, there’s a widespread belief that the worst is behind. However, the global picture suggests that a lot of challenges lie ahead, and expecting India to be shielded may not be a valid argument.

The last decade has been marked by the Non-Banking Financial Company (NBFC) boom leading to a consumer culture. It’s important to note that all of this pertains to a small segment of the Indian population. Unlike other major economies, talking about the whole of India in any aspect would be unwise due to the vast gap. Continuing with the consumer culture, the boom has been fueled by debt, and we may be at the later part of the cycle. The tipping point, as always, is caused by debt levels rising more than income, and unemployment plays a critical role in debt repayments.

The decade started with bank reforms, and NBFCs have played a major role since then, leading the consumption boom. However, it must be noted that financial literacy and prudence may be lower among those taking on easily available leverage for the first time. ‘Buy now, pay later’ and credit cards have become the norm for the first time, and this should be viewed as high risk. A comparison can only be made with the US in the 1930s, with a stock market boom, consumption boom, and ‘Buy now, pay later’ trend.

The role of the IT industry in this boom cannot be downplayed. It has created high-paying jobs and the affordable class in India in a major way. For the first time, we may be facing a stagnation in job growth in the industry, and this is a significant tipping point. As income reduces and unemployment in this sector increases, it can cause a tipping point with ripple effects that India may witness for the first time. The global picture clearly points to an extended recession, and AI adds another layer of uncertainty. Over the longer term, the industry will no doubt adopt and create new employment, but a recession may create turmoil.

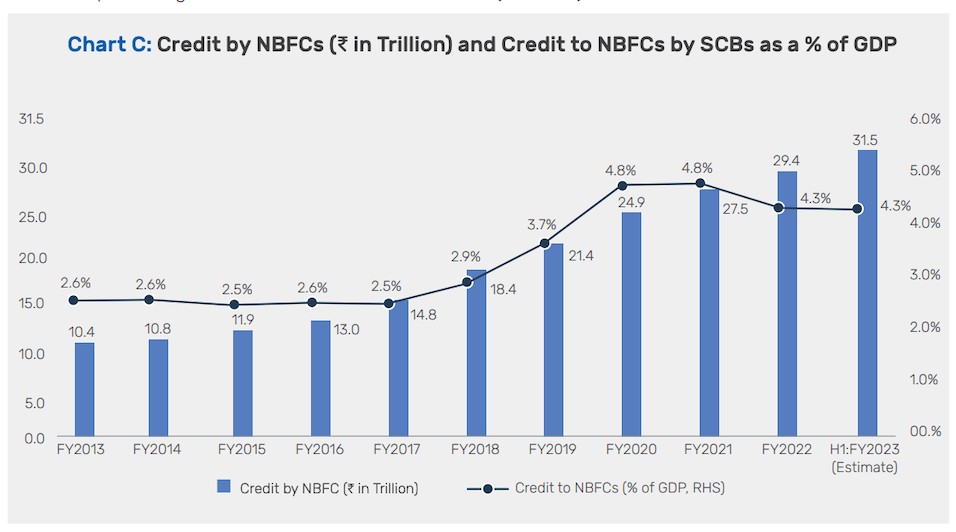

The decade that started with credit to NBFCs at 2.5% of GDP has risen to 4.3%, and from 10.4 trillion to 31.5 trillion, causing concerns of systemic risks. Another dynamic that has played out is that banks have, in turn, resorted to much lower provisions, considering these loans to NBFCs safe. This may well be the hiding point of risk in this cycle. The loan growth of NBFCs has been a staggering 20% plus Compound Annual Growth Rate (CAGR), which is in no way sustainable for an economy growing at 5% to 7% GDP growth. When NBFCs go through the down cycle, the risks will also shift to the banks.

It’s worth noting that mid-year, the Reserve Bank of India (RBI) also highlighted the issue. The RBI noted that certain pockets of Non-Banking Financial Intermediaries (NBFIs) have high leverage, posing systemic concerns. The RBI stated, “Elevated levels of off-balance sheet financial leverage indicate that overall synthetic leverage may be approaching historic highs.”

Loans by NBFCs are much riskier compared to bank loans. Banks are regulated to lend minimally to high-risk borrowers, and most of their loans are asset-backed. Their lending rates are also lower, enhancing the repayment capability of borrowers. NBFCs, on the other hand, have a higher cost of capital compared to banks and lend to high-risk borrowers, making them more fragile. There has been significant growth in unsecured personal loans and loans against securities, both of which are high- risk, especially during economic downturns. This makes the lending cycle riskier, given the inherent risk in the lending itself, without even considering lending standards.

During the upcycle, borrowers tend to keep borrowing more as asset prices rise, providing room for additional borrowing. When the cycle turns, each change has a ripple effect on another. Lower asset prices lead to margin calls, and increased unemployment also affects lower equity levels. Selling of shares for margin calls results in even lower asset prices, creating more margin calls—a development that forms a vicious cycle.

Another major sign of a financial tipping point is the lower provisioning of PSU banks. Compared to the previous decade, post-pandemic provisioning has consistently decreased, resulting in higher short- term profits. While the markets celebrate this, it must be kept in mind that the structure of these entities does not necessitate tight lending standards. Various influences tend to play out in the lending process, and judgment day always arrives sooner than later. The challenging part is that this has a ripple effect. During a downturn, delinquencies rise, and lower provisioning leads to the need for even higher provisioning, further impacting profits.

The need to raise capital arises for all banks simultaneously, just as credit contraction leads to illiquidity, and investor sentiment is at its lowest. Keeping a level head during an upcycle, with proper capital raising, lending standards, and provisioning, is essential for financial entities to navigate through rough tides. Financial entities have the accounting magic of adjusting provisioning to their will. As investors, it’s nearly impossible to know the entities’ lending practices and their risk analysis. Hence, every time the cycle tends to surprise. But low provisioning always leads to difficult situations down the lane.

It’s crucial to note that global tightening will result in credit tightening in India, at least relative to the last decade. The lower interest rate differential and currency depreciation may cause foreign outflows, further weakening the currency. This makes lowering interest rates within the economy very challenging until the global macro picture changes.

Despite all the risks, I reiterate that difficult economic situations provide the best opportunities to invest.

– Dr. Siddarth.K.J

Fund Manager